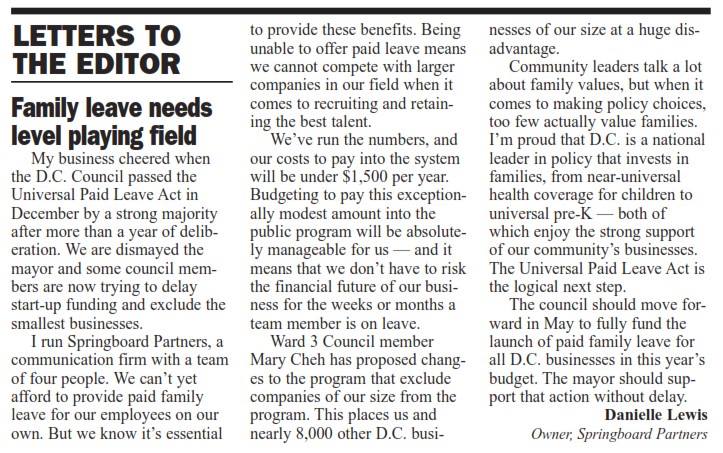

Several weeks ago, I wrote about my experiences with the D.C. Paid Leave Coalition, a great group of advocates here in D.C. who have now spent over two years trying to get the D.C. government to pass a fair and feasible legislation that guarantees paid leave to all employees of D.C.-based employers for pre-specified periods of time. I also wrote about how that legislation, called the Universal Paid Leave Act (UPLA), had been plunged into an existential crisis of sorts.

Since then, I have joined my Paid Leave coalition friends for more visits at various D.C. Council Members’ offices and tried to stay on top of the latest developments. The most recent concerns about the future of the legislation involve a flood of new alternatives to the UPLA proposed by various members of the D.C. Council, including by its Chairman Phil Mendelsohn.

First, the good news. The benefits that were originally proposed under the UPLA appear, for the most part, to be safe – 8 weeks of paid leave for new parents, 6 weeks to care for a sick relative, and 2 weeks to address the employees’s own health needs.

The bad news? Second thoughts about its implementation. After months of debate and deliberation, the D.C. Council had originally approved a “social insurance” model to finance and implement the paid leave program. Under this scheme, all non-governmental D.C.-based employers would pay a small, incremental payroll tax (under 1 percent) that would be entered into a common pool to finance the benefits for all employees. The program would be administered and implemented by the D.C. government, a neutral third party.

This financing model is similar to those adopted by successful paid leave programs in other states (such as California). But apparently its not good enough for some members of the D.C. Council, who appear to be turning their backs on the social insurance model. In recent weeks, several members have introduced alternative proposals such as the “employer mandate” model, in which employers are required to directly provide the benefits of the UPLA to their employees. In order to do so, they must figure out their own insurance solution and how to administer the program. It is not clear who will enforce the “mandate” and ensure that employees are actually provided the benefits they are promised under the law. So there are plenty of risks here. Some other Council members have proposed “hybrid” models, which involve a smaller payroll tax to finance and administer the program for small employers (who really need the insurance), but preserves the employer mandate for larger employers. Again, without a clear understanding of the enforcement plan, it is hard to assess how effectively the mandate would work.

The reason for the reversals? It’s D.C.’s big business lobby that has always voiced the strongest opposition to the UPLA. After all, the reason the UPLA exists is because left to themselves, most employers chose not to provide the benefits required by the UPLA. So of course, many employers oppose the provisions of the law. But some members of the D.C. Council appear to be swayed by their opposition. And the employer mandate (or hybrid models that adopt some of its features) is being dangled as a carrot to appease big business.

So let’s take some of the most common criticisms of the social insurance model and see how well they stand up to facts.

Claim: Businesses really, really, really want the employer mandate. Seriously, all of them do.

Wrong. Small businesses would struggle under the employer mandate and they fully recognize that they would. Small businesses do not have the resources to absorb big financial shocks. That’s why they need the insurance. For instance, suppose three out of ten employees in a small restaurant were to need paid parental leave in the same calendar year. In the low-margin restaurant business, the restaurant owner would find it tremendously hard to provide this leave to all three employees at the same time. But you know what the owner can do? Pay a small annual payroll tax to make its annual contribution to a common insurance pool that would cover all its employees’ family leave.

Claim: The employer mandate is less costly for businesses.

Almost certainly wrong. There is no proof of this and no reason to believe that state-provided insurance is more expensive than private insurance. In fact, it is reasonable to expect the opposite to be true (e.g., the social insurance model would pool risks for a bigger base of employees, which could lower costs). Which brings me to the following thought experiment: we are supposed to believe that employers expect to provide the full set of benefits required by the UPLA under all alternative financing scenarios. But doing so privately under the employer mandate model (or some form of the hybrid model) would likely cost employers more. So why do they support it? What do they know that we don’t? For instance, could they be betting on the employer mandate model because they don’t intend to fully comply? I don’t know about you but smells just a little bit fishy to me. The least the Council could do is to ask businesses to substantiate such claims: how exactly do they intend to provide all of the same benefits for lower costs?

Claim: Small employers would not pay their fair share under the social insurance model.

Mostly wrong. The social insurance model works like this: each employer pays a tax that is proportional to its total wage bill. This creates a common pool of funds that is then used to finance the benefits for all eligible employees. So if you are a mid-sized employer that pays higher wages, you will contribute more into the pool than a same-sized employer that pays lower wages. But that’s all fair and fine, because when the higher-wage employer’s own employees need paid leave, they have to be paid more. So employers are generally contributing in line with their expected benefits in the longer-term. (I say “generally” because employee demographics (e.g., age, gender) — and correspondingly, the amount of paid leave requested of the employer – may vary across employers. Its also true that the UPLA benefits are capped at a maximum allowed amount, meaning that the highest-wage employees will not be reimbursed fully for all of their lost wages when they take family leave. But there is no reason – and no convincing evidence – to believe that small businesses would derive systematically more financial benefits than big ones under the social insurance model).

Claim: There is no evidence that a payroll tax-financed model would work better than the other alternative proposals.

Extremely misleading. The states that currently provide paid family leave in the US – California, New Jersey and Rhode Island – do so through social insurance-like models. So it is kind of popular. To the contrary, there are no paid leave programs in the US that are financed fully by the employer mandate. So its not clear how one would empirically compare the performance of the alternative models. It’s kind of like saying that there is no evidence that life on Earth is better than life on Mars and then walking off feeling like a winner.

Claim: The paid leave benefits would be the same under all financing models. So just chill out, everyone.

Misleading. In theory, yes. Like I mentioned before, most Council members have publicly said that they don’t want to mess around with the originally promised benefits of the UPLA. However, the employer mandate model is only as good as its mandate. Employers have an incentive to deny the benefits to their employees if they can get away with it. So if they can, they will. And we do not yet know what the Council or the Mayor’s plans for enforcing the program would be under the new alternative proposals. So in practice, the benefits provided under an employer mandate may well fall short of the goal.

Claim: The increased payroll tax would stall growth and employment in D.C.

Nope. Check this out. According to this thorough analysis of the program by the D.C. Council Budget Office, the D.C. economy will be at least 99.9% as large as it would be without adopting this program. 99.9% not good enough for you? Then consider this: that study does not compare the various financing models – rather, its a comparison between imposing the 0.62% payroll tax to fund the UPLA and not having a paid family leave program at all. That’s (thankfully) not where we are today. We have been promised the benefits of the UPLA through some means – someone is going to have to pay for it – and the question before us now is what form of financing works better.

Claim: The social insurance model would make D.C.’s bureaucracy larger.

Probably, but…of all the arguments against the social insurance model, this one probably has the most bite. The Washington Post – in what was clearly a measured and balanced piece titled “The District passes an irresponsible, ill-conceived and extremely expensive bill” – pointed outthe many challenges of implementing the social insurance model: D.C. would have to build the administrative and technological infrastructure from scratch (other states with paid family programs built their systems on top of existing short-term disability program systems); estimates for the program’s start-up costs run up to $40 million; the integrated information technology system required to implement the program would be complex; and over 100 new employees — claims specialists, customer service, medical/insurance experts, management, administrative law judges and tax processors — would have to be hired. Sounds complicated. But the D.C. government is committed to providing paid leave. So the issue now is the method of financing. Does the social insurance model create a bigger bureaucracy? Probably. But would the employer mandate model involve some role for the D.C. government? We should hope so. As I pointed out several times, enforcement of the program is critical to the success of the employer mandate model. Someone’s got to make sure that the employers are doing what they are required to do. And that will require government involvement. The hybrid models will still tax employers (a smaller amount) and will create a pool for the small employers. It will also require enforcement and supervision of larger employers. So the D.C. government will have to be involved in all of these scenarios. So the question is to what extent and how much will the D.C. government’s involvement cost in the different scenarios? We don’t know and no one on the Council seems to be addressing this seriously.

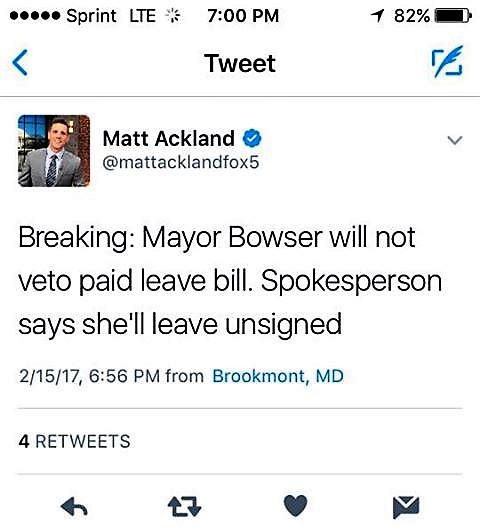

So there are many reasons to support the original financing and implementation model proposed by the UPLA and too many potential downsides in each of its “repeal and replace” counterparts. Want to let your Council Member know how you feel? Take to social media and tweet at them. Visit their offices and lobby with the DC Paid Leave Coalition. Or better still, show up in person to testify at hearings and make sure your voice is heard. Let’s get paid leave, D.C.! Choking at this stage should not be an option.